It’s already been since stay-at-home orders began in Illinois – and pretty broadly across the nation. We’ve adjusted pretty well.

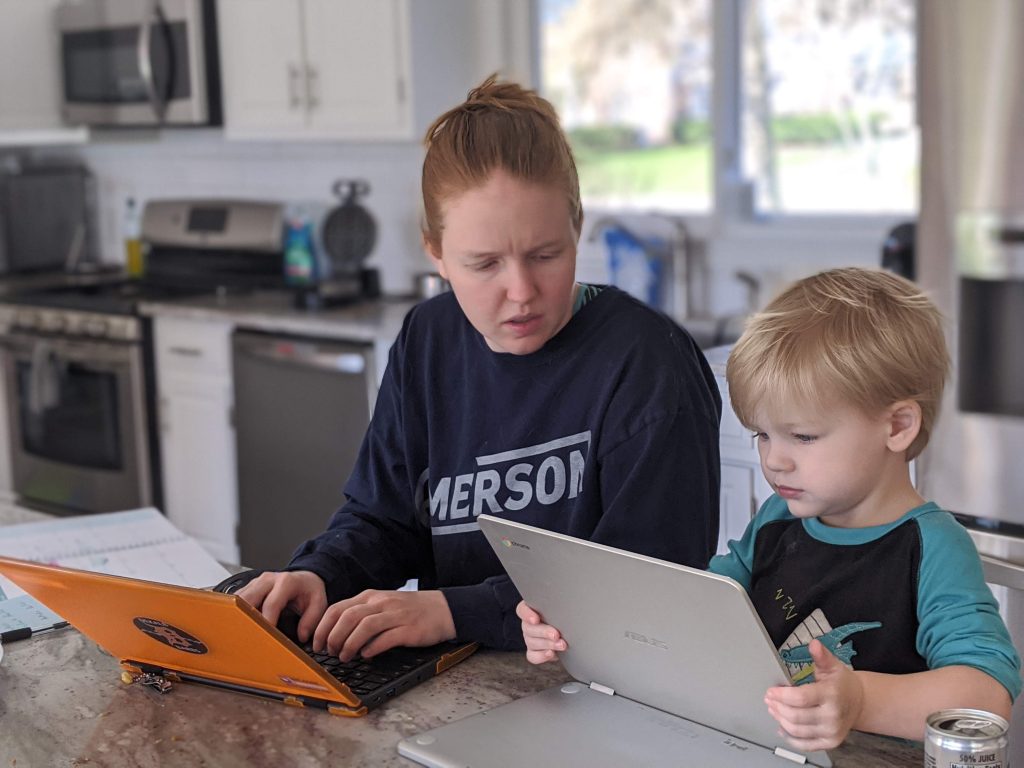

Karissa, the teacher, is enjoying e-learning and e-teaching. Her biggest source of anxiety, stress, and dissatisfaction with her job stemmed from behavior issues of her students. With e-learning, behavior isn’t really relevant. So she posts her work, helps as needed with e-mails, and enjoys her day.

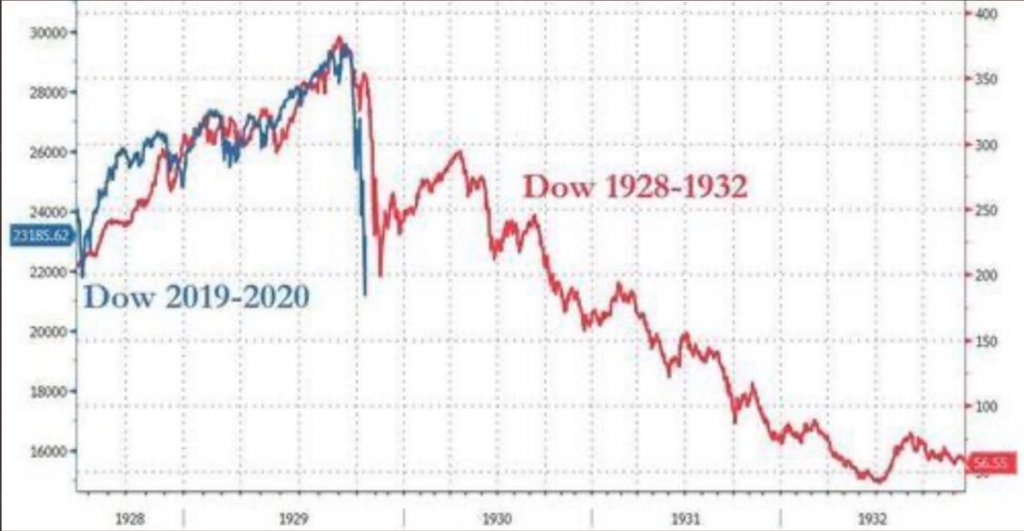

With the stock market volatility, I’ve become bolted to my chair and doing my best to trade through the turmoil. The low-stress strategy I’d been using didn’t require much monitoring throughout the day. It just doesn’t work when stocks have been moving so wildly. So I’ve become more nimble and more active.

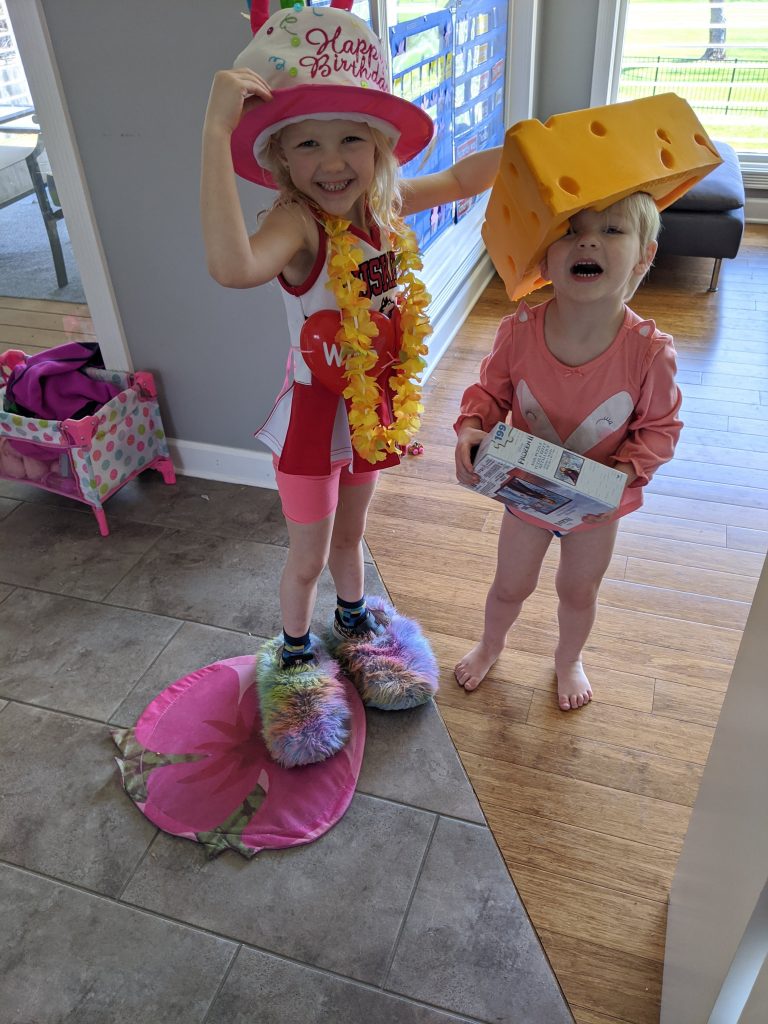

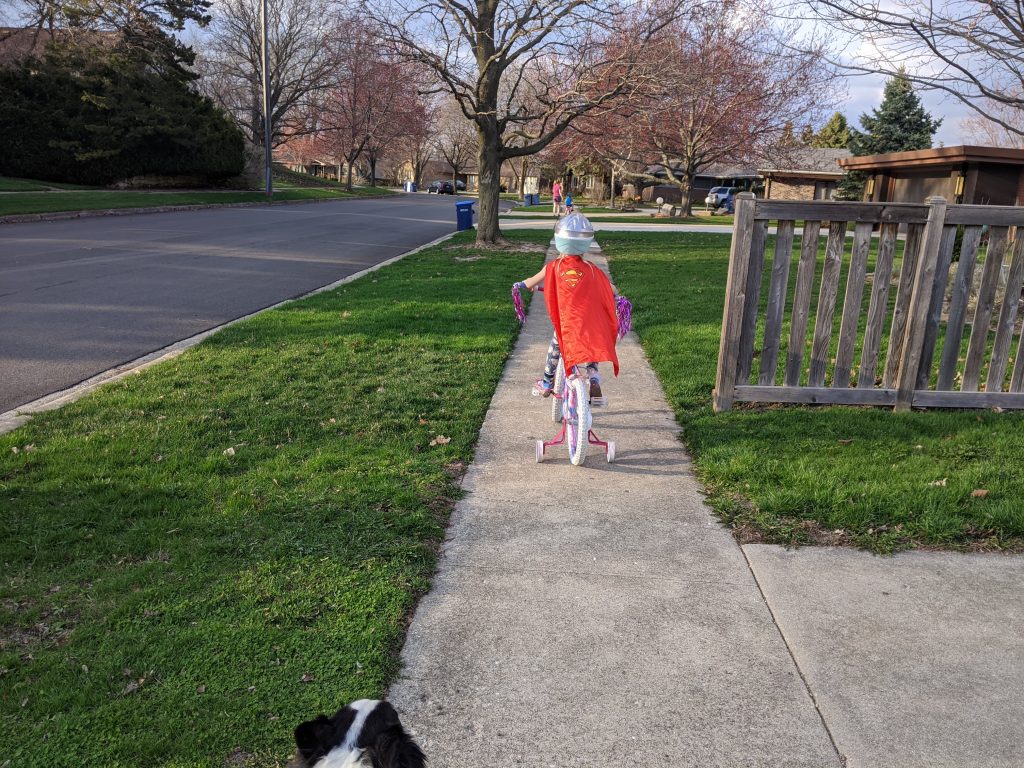

The kids are more or less unaware that life is different. They understand that everything is cancelled and that everyone could be sick, but that’s about it. They are enjoying playing together and have gotten used to the new daily routine.

After our work days are over, we work on house projects. And take bike rides and walks. We’ve even started letting Emerson put on the golf course in our back yard while Adelaide plays with her guinea pig, Brownie. Other than not being able to go to the grocery store (we’ve finally started ordering grocery delivery), it’s pretty idyllic.

This isn’t a political or current events blog – just the story of our family – but this pandemic is bringing out some nutballs. How can people think it’s fake? How can people think Bill Gates is to blame? And how can they not understand that we had no choice but to shut everything down when we didn’t know the extent of the spread (and still don’t as of 4/11/2020) ?

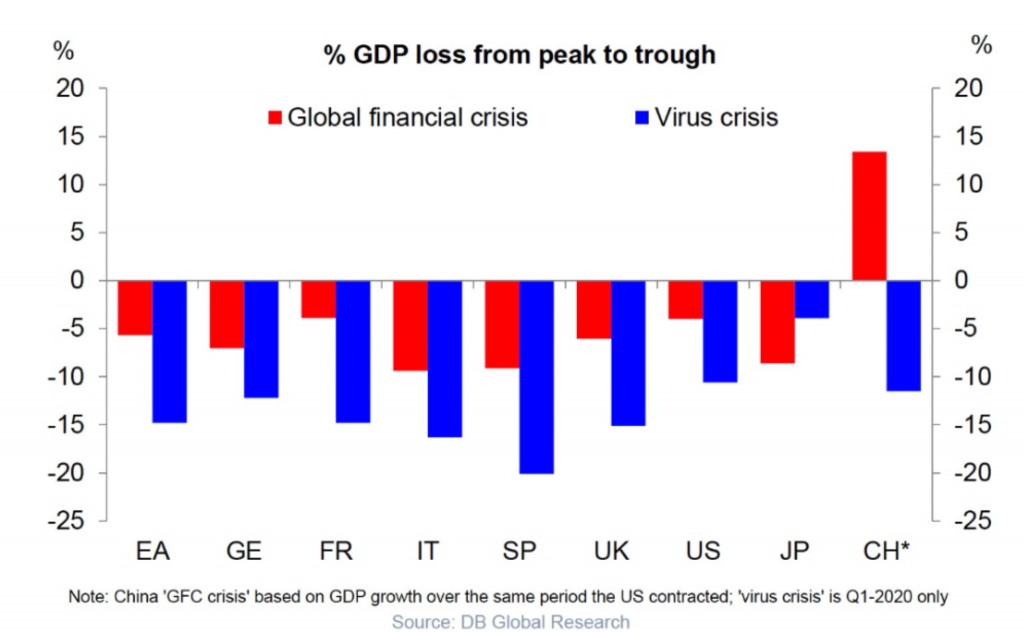

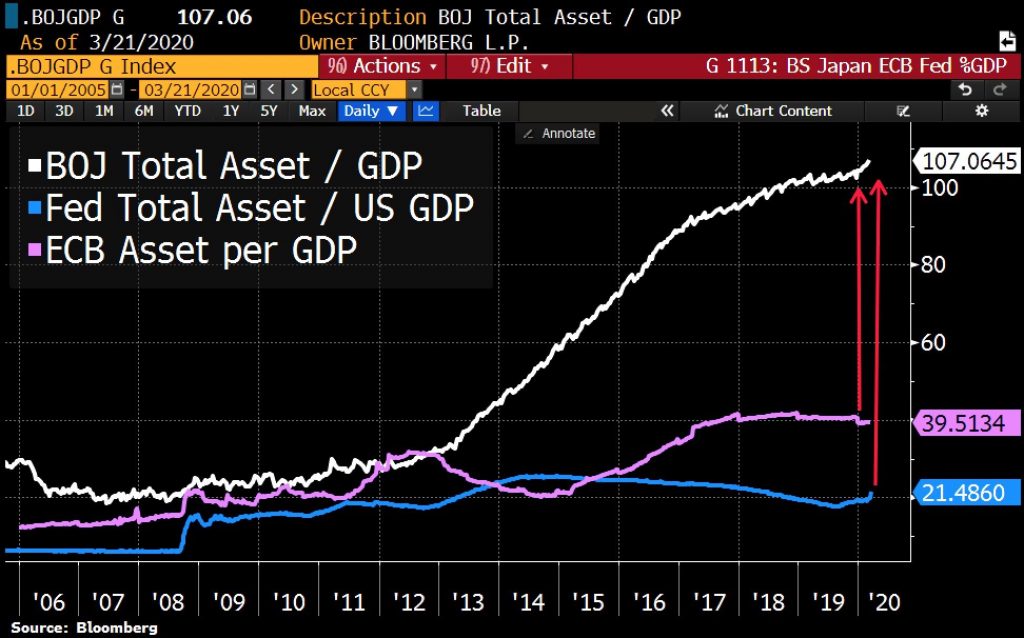

This also isn’t an investment advice blog, though I’m thinking of starting one – let me know in the comments…The return to normal life is still a long way away. Even if the economy reopens over the summer, it’s going to be very different until a vaccine is created and distributed. Who’s going to want to sit in a crowded movie theater, theme park, or stadium? The 16+ million newly unemployed aren’t all going to get a job back right away. The economy was slowing and showing real signs of stress way back in October. If you own stocks and are lucky enough to be down “only” 15-20% from the highs – take this as an opportunity to sell. I see rough times ahead. The Fed hasn’t yet started buying stocks – and even if they do, it might not help prices for long. Economic gravity can’t be ignored forever.